They Are Right About Inflation

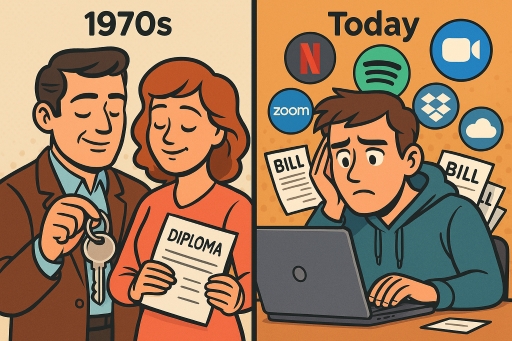

You’ve heard it before. “We dealt with inflation in the 70s. You’ll be fine.” They are right about inflation—sort of. But today’s economic landscape is a whole new beast.

The Subscription Economy Trap

You review your bank statement. Netflix, Spotify, Dropbox, Zoom… how did it get to 18 subscriptions? You cancel three. The total savings: $27/month. It doesn’t feel like much. Your parents bought things once. So, they owned them outright. Simple. Then today, you juggle fifteen or more monthly subscriptions across apps, streaming, and storage. Each feels small. Together, they bleed you dry. They also escalate yearly, often without warning or consent. Meanwhile, your brain quietly monitors each one. Meanwhile, that silent stress adds up. Consequently, these charges aren’t just financial—they’re psychological.

The Education-Debt Complex

You make your 97th student loan payment. It’s automatic now, like rent. You remember your dad’s stories about paying for college with a summer job. Your parents paid college tuition with summer jobs and part-time work. You, however, carry student loans larger than many mortgages. College costs grew eight times faster than wages. Debt now delays homes, families, and wealth-building milestones. You don’t just owe money. You lose time and opportunity. New repayment tools help, but the system remains overwhelming.

The Housing Market Revolution

You scroll through Zillow listings with disbelief. A tiny condo costs more than your parents’ old house. So, your parents bought starter homes in their 20s with modest incomes. Then you compete with investment firms offering cash on day one. Remote work inflated prices in desirable cities and unexpected towns. Starter homes disappeared. Equity ladders now feel like myths. Every open house feels like an auction. Most end in heartbreak.

The Gig Economy Paradox

You juggle a full-time job, freelance design gigs, and weekend rideshare driving. Your parents had stable jobs with benefits and predictable raises. You hustle across jobs, gigs, and side projects to stay afloat. Income varies wildly, but expenses only rise. Healthcare costs crush freelancers with no safety net. Self-employment taxes quietly punish independence. Modern workers pay more, get less, and absorb all the risk.

The Digital Price Maze

You try booking a flight. Therefore, the price changes depending on time, browser, and device. Likewise, your parents compared prices at the mall or a few local stores. Then you navigate algorithmic pricing, surge rates, and opaque digital fees. Moreover, online shopping feels like solving a riddle with moving parts. Different devices show different prices. Furthermore, loyalty sometimes costs more. AI-driven models personalize offers—and not always in your favor.

So What Now?

You don’t lack discipline. You face a different economy with new rules. Old advice has value. But it needs updating. Today’s challenges require modern tools and smarter strategies. Additionally, subscription trackers help you cut waste fast. Income-driven repayment plans give breathing room. Scholarship engines and alternative programs offer low-debt pathways. Furthermore, budgeting apps support unpredictable incomes. Portable benefits platforms protect freelancers from financial shocks.

Are They Right About Inflation? – The Bigger Picture

This isn’t about blame. It’s about adaptation. Understanding these shifts builds empathy and bridges generational gaps. You deserve more than outdated lectures. You deserve tools made for your world. We’ll keep exploring those tools and tactics together. Because surviving this economy takes more than grit. It takes insight, innovation, and community. And you’re not alone in the fight.

Leave a Reply